I could also see a play, where this move brings growth by marketing to all the folks that get sucked into the life insurance 3a.

Based on my calculations (using the current insurance rates), it’s around 5 - 6 basis points.

Totally unnessecary cost. It’s not even a good insurance. If I die with 80k in 3a, what difference will the 20k make for my family? Or if I get disabled, what’s the point if it aren’t regular payments?

As you can see, as soon as someone starts posting referal codes again, this topic starts going nowhere and degenerates into who will post the most codes.

The rule is still the same, we do not allow posting referal codes in public, please do it via DM.

I will maybe finish this year with viac and next year start with finpension (in addition I am thinking of leaving the country before 65)

Is it easy to manage “strategies” etc with Finpension?

Now that I’m used to Viac …

I don’t understand why are you complaining about this new features from VIAC ? They implement something free for you, just take advantage of that… Don’t forget that for some people, having a free life insurance can be really usefull, for exemple independant who are using VIAC 3a and who can maximise not CHF 6’826.- but CHF 34’128.-

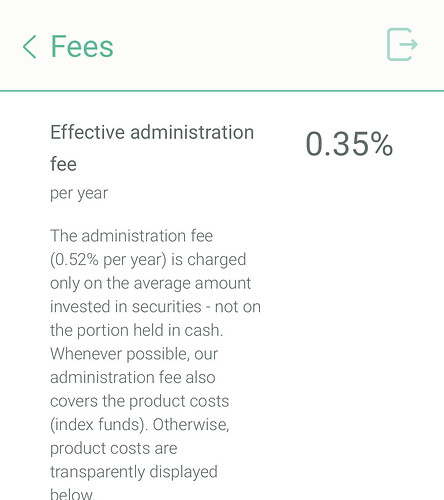

Yes, the TER of 0.52% is higher than Frankly (0.47%) or Finpension (0.42%) but don’t forget that is only true for the maximum allocation… When you have a strategy between 0-60% equity allocation, VIAC is still cheaper than Frankly and Finpension.

Personaly, I take this new feature as an advantage (don’t want it, but since I’m not paying for it so, everything is fine) and I think that I will open 2 others 3a account in the next years : one to Frankly and one to Finpension.

What are you talking about? We are paying for it! Instead of reducing the TER down to 0.46-0.47%. they added this useless insurance.

Nothing is free in this world.

Some money went into this and many here, myself included, would have preferred to see that money go into lower TER.

For the non-equity part, VIAC uses liquidity. Frankly and Finpension use bonds. In a way, it’s normal that liquidity is cheaper.

What you don’t seam to understand is that it’s not free. This is covered with the higher TER compared to the competitors.

Hi! VIAC user here, and after this nice trojan horse of the life insurance thinking seriously of changing.

If we consider merely the costs, which I’m incline to do, I should choose finpension. Anyone with a good reason not to?

Cheers!

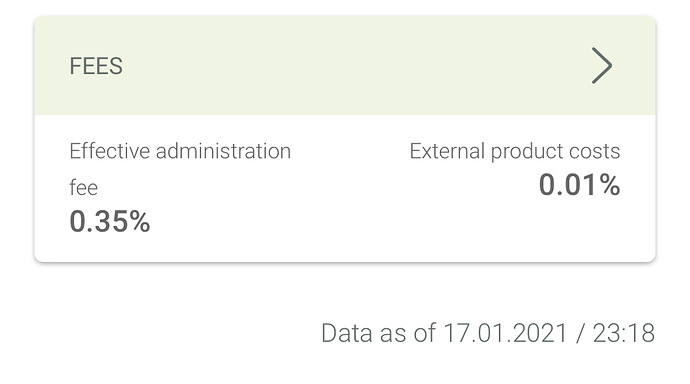

Does anyone know how Viac calculates its costs? This article says that they are only 0.39%, but the website says 0.59%? Or do I not understand something? Doesn’t finpension have a fee of 0.39?

The cost depends on the % of the stock allocation. Maybe there take the average customer with 60% stock

It’s a fast moving market. I expect more products to be launched in the near future. ZKB launched Frankly, and Credit Suisse, albeit not a 3a pillar, has shown with CSX that they’re not sleeping. Who knows what else is coming.

I wouldn’t want to move my assets around all the time, chasing 10 basis points here and there.

I do have an “old” 3a account sitting around and want to move that, though. I already have some 3a assets at VIAC (and don’t like their insurance crap at all); Frankly seems a bit intransparent to me; FinPension looks good though. At least at this time they do.

My thoughts too! I’ll stay with Viac for another 5 years for sure. Then I’ll look at the 3a market and see what’s best.

I would suggest contacting VIAC directly from the app and letting them know about their insurance offering if you are not happy with it. They are quite good about reading and responding.

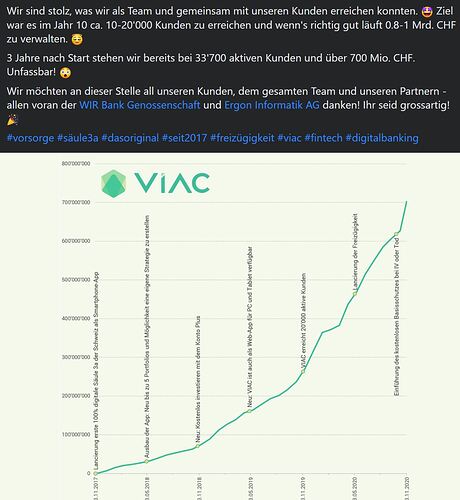

This ad just popped up in my Facebook, and I thought I’d post it as an update about how they are growing, they’ve been around for 3 years now and they should be at an AUM of 1B by end 2021. 1 year = 100M, 3Y=700M. Good growth. And yes, hopefully they can use the increased AUM to even further improve the conditions, fees etc. for the clients ![]()

On the website it’s still 0.51% for me.