why is it so important to have web access? I agree it’s funny how the modern kids do everything on the phone, but it’s not like you’re gonna need this web app to manage 6000 CHF, or? There is any way nothing you can do, and I imagine that VIAC, as an admitted 3a provider is somehow audited by the state (or am I dreaming?).

Because I hate doing things on my phone

It’s not a trust issue, I just don’t like phones.

I actually do all my investing/trading on IB from the phone app, I find it much easier to use than the browser version.

Huh. Actually they say a lot of things for this spring e.g.

- possibility to have multiple acounts

- possibility to adjust the portfolio within the constraints or their approved ETFs

Both features are more important (in this particular order) for me than web access. Actually I see me buying and holding for the next 20-30 years so I’ll probably access the interface once in a couple of months.

This web access requirement seems funny to me. Just download the app, send the money and forget about it. What do you want to manage there? It’s funny money anyway. And in 1-2 years they will probably release the web app.

Anyway, if these guys have AUM of 2 million CHF, then with a custody fee of 0.50% they make 10’000 CHF per year. They would probably need to reach at least 100 million to keep this thing going.

Edit: I just looked around their website, and I found a blog post, where they put a chart, according to which they raised 6 million until the end of 2017. I hope this year they will reach even more people and we will see some serious numbers

By the way, how often can you transfer money to VIAC? Is it possible every month?

I think you can transfer as often as you’d like, but they only buy shares once a month. On the 1st or next working day, I think.

This is indeed how it works.

And if I want to do it with a single transfer of 6768 CHF, do I need to make the transfer until last working day of the year?

That’s not an issue. On the tax side, it will be counted in the 3a even if the money is not invested yet.

Hi there - sorry that I didn’t contribute myself directly in the last weeks. Always great to read through your posts, gives us feedback and inputs!

To clarify some things:

What will be the major features for the Update by the end of May?

- Multiportfolio: It takes you 10 seconds to add a 2nd portfolio. You can have no more than 5 portfolios. each portfolio can have a different strategy.

- Individual Strategy: You can create your own asset allocation. Out of our preselected index funds and ETFs you can create you own strategy in 1% allcation steps.

- Reward Programm: I don’t want to state all the details, but it’s defenitly worth more that the 10.- from ZAK  - stay tuned!

- stay tuned!

And some minors improvments as better notification settings, better performance drilldown - but still TWR  and more. Can’t wait to get your feedback

and more. Can’t wait to get your feedback

Future: We are working on the Webversion and the 2nd pillar (Freizügigkeit) - but not yet sure when it will be available - probably fall 2018.

Regards Daniel

We didn’t make it public so far, but we hit 3’000 customers last friday…

This is great news. Are there any limits for the individual asset allocation or can I put all my money in SPI Extra?

@VIAC

yes, sounds great!

I would be highly interested here. In case you are planning something similar as with pillar 3 (low-cost, high stocks-exposure) i will be eager to know about!

Unfortunately only 35% (to cap the exposure to the underlying single stocks of the index). But if you like small mid caps, you will be able to add “CSIF (CH) World ex CH Small Cap” for example. Stay tuned!

It will be great, sooo great

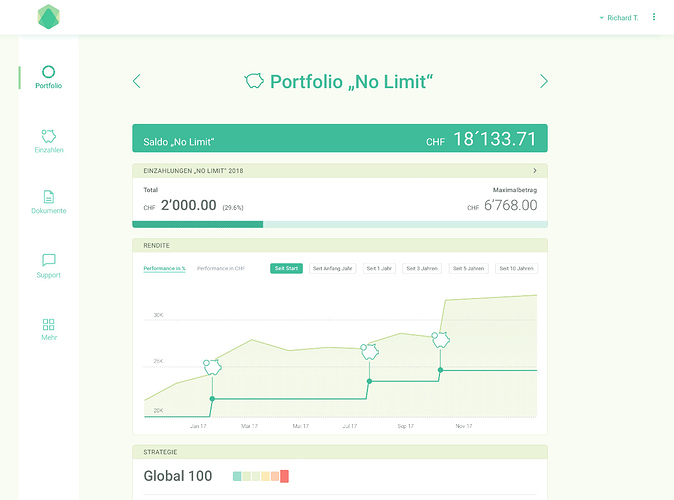

(btw this is the first time ever, that we made a screen of the web-version public…)

What does Freizügigkeit mean? It would be cool if you introduced a mustachian-friendly 2. pillar. Then I would definitely show it to my boss.

That will probably be for self-employed people without 2nd Pillar. They are allowed to pay up to CHF 30k-something to their 3a.

It’s not the same:

Freizügigkeitskonto in 2nd pillar is used when you are not currently connected to a Pensionskasse, either because you are unemployed or you are self employed. This is where your 2nd pillar money will be stored until you connect to a new Pensionskasse.

The big 3a for self-employed people that don’t have a 2nd pillar allows you to pay up to 20% of your income or max. CHF 33’840 into your 3a.

Some people are able to hide their Freizügigkeitskonto from the new Pensionskasse and keep it there. The law is clear on this: Your money has to go to the Pensionskasse, but might be worth a try. Not sure what the risk is.

@VIAC Will there be a minimum swiss allocation we need to have when creating own strategies? If yes around where will it be?