you can build your own portfolio with VIAC…

Well, you could start by investing the first 6K into 3a, and the rest outside of it.

Where have you read that it’s better to invest outside of 3a on the long term? Can you give me a link, I’d be interested

https://forum.mustachianpost.com

I’ve read it here. You might save X CHF of taxes the first year, but that amount might be less than the amount you make by investing them in ETF for Y years. Being able to invest inside 3a, might make the calculation difficult.

Say you save 300CHF, you must then calculate how much you lose by investing in ETF in VIAC versus ETF on IB and see when the are the same. If you don’t use VIAC it might be easier to calculate. 0.5% of VIAC vs 0.1% of another ETF means ~27CHF difference for the first year

Don’t forget that 3a dividends are tax free. That could be 0.3% saved annually. But of course when you pay out, you will need to pay a tax.

But I still haven’t invested in VIAC, or any other 3a. I think I prefer to lose these couple of francs and focus on other stuff, like work. And splitting it all into 5 accounts, that seems to me like such an overkill. I’m not saying it’s a bad financial decision. If you have the mental capacity to keep it all in check, then sure, go for it.

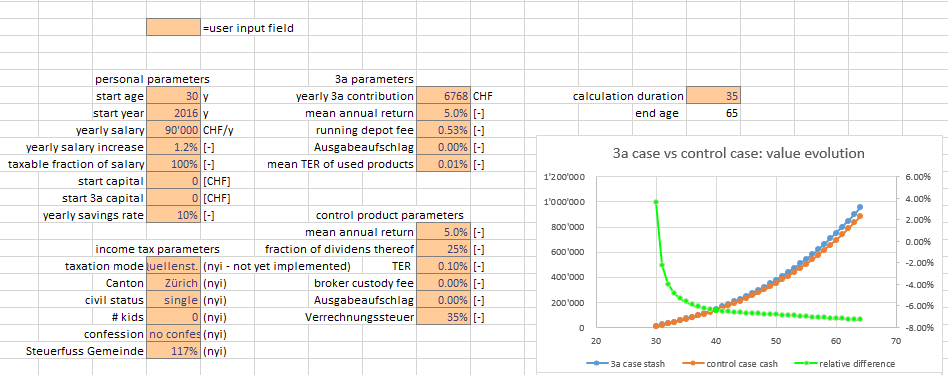

I tried to model and simulate the 3a vs non-3a, (see my calculator from back then) and i found a modest 0-10% advantage after 35 years of using 3a over non-3a, with tons of assumptions:

including modeled source tax, verrechnungssteuer on dividends, depot fees, and tax refund, and Kapitalauszugsteuer

so to squeeze the last bis out, probably 3a is worth in case of a n agressive stock-only allocation that performs equally well as its non-3a counterport (VT, for example). This does not reflect differences between our beloved vanguard ETFs and thos Credit Suisse Index Funds VIAC is relying on.

have to look into that calculator still, but on a similar note, what I was trying to argue about is that 3a is an excellent place to hold (emergency) cash, because:

- it pays higher interest on cash than saving accounts

- you initially get that income tax deduction which, based on only holding cash, should be higher than the Kapitalbezugssteuer

- if you need (emergency) cash, you can always liquidate ETFs outside 3a and buy into funds within 3a - on the same day or next day usually (so without much market risk)

Of course this implies that you do hold any cash somewhere and aren’t 100% into ETFs - which is a whole other discussion

That’s just another overkill IMO. Cash is also an asset and I believe that, especially in times of prosperity and record breaking indexes, you should keep a small cash position.

I am not surprised as I arrived to similar conclusions but with another calculation.

My calculation is based on how much does I save on tax and how much does the third pillar cost me each year.

I also expect that in ZH there is almost no advantage but in NE there should be more substantial advantage.

what’s the overkill?

I think the tax saving of wealth tax and dividend alone more than offsets other consideration.

I have 0.18% wealth tax… So depending on the cantons the tax savings can be big. Of course you would need an high percentage of stocks

The tax advantage of third pillar come mostly from reduction of income and consequently income tax.

The cost of third pillar comes mostly from wealth accumulated as the fees are proportional to the value of asset under management.

When you are young and no wealth has been accumulated you have the feeling to make a good deal no matter the cost of the found in which you invest the third pillar money.

Once you have a decent wealth accumulated then you realize that the cost of the found begins to be higher than the tax saving.

I don’t get it. Does 3a get included in wealth tax calculation? If not, then you should save even more. If yes, then what’s the difference?

it does not get included

Wealth tax is maybe 0.3% at maximum while TER on the third pillar is usually between 1 % and 2 %. The TER is killing any fiscal advantage once you get between 100’000 CHF and 200’000 CHF.

Living in one of the tax hells, I have around 0.5% wealth tax (and no, not a millionaire). So that’s surely a factor to consider, although who knows where one might be living in 5 to 10 years, and 3a is longer term than that. So I would calculate with tax rates that are a bit averaged for a few cantons.

What has an effect too and is often forgotten in these calcs IMO, is that Vermögenssteuer is also a progressive tax (although progression not so strong), so one should actually even calculate with & talk of the Grenzsteuersatz when analysing its effect.

By having say 100’000 of total wealth 500’000 in 3a one “saves” almost 0.7% (instead of overall rate 0.5%) wealth tax on that 100’000 in 3a.

But viac is only 0.5%, so why are you talking about 2%? And your wealth tax rate will only get higher and higher. I really dont know what to think about the 3a…

VIAC is a good solution but is only a small part of the total market of the third pillar. I expect that for 98% of the people invested in a third pillar my value of 1-2% is correct and only for the small minority working with VIAC a TER of 0.5% is correct.

I see. But you shouldnt say “3a is bad because most people do it wrong”. We should talk about the best option available to everyone. I guess most free market investors are also not investing through index etfs, but also through active funds yielding 1-2% in fees. But of course youre not going to compare with them, makes no sense.

You are absolutely right when you say we have to compare the best options in both sides (third pillar or taxable wealth). The market is free and people are free to chose the best solution. My point of view here is that the market is more free on the taxable wealth because you have access to a lot of ETF, including the products from the EU or US. For the third pillar you are confined on the small swiss market and its specific legal aspects on this product. Even with VIAC in the game, it is not possible to say that there is a lot of competition on this market and it is not really free.

Practical example, if you have a mortgage on your apartment with the bank X or Y it will be very difficult to work with VIAC as the bank will try to link mortgage and third pillar.

fyi : viac web version due in 1 month, or so, they tweeted yesterday :

Viac App (@viacapp) Tweeted:

@mpas97 @ErgonAG Hier ist leider noch etwas Geduld gefragt - dies da wir noch einige Verbesserungen vorgenommen haben. Es dauert aufgrund von Feiertagen sicherlich noch einen Monat bis sie öffentlich zugänglich ist. https://twitter.com/viacapp/status/1115608402267443200?s=17