Hello community, I am about to create a new account at VIAC, does anyone have a referral code to share with me by chance?

Thank you very much in advance.

Hi. I have just sent you one.

hello,

For those who need a referral code please find below :

Ku3rea

M50Agp

NQzU8y

if they are already used, do not hesistate to check : https://forum.mustachianpost.com/t/viac-third-pillar-referrals

Quick question: Are there any downsides to opening 5 accounts with VIAC right away? I currently don’t have any pillar 3 account.

There are two things I could think of:

- VIAC charges 300.- when you want to transfer to another bank. Could it be, that it’s 300.- per account? So transferring 5 accounts would then be quite expensive with 1500.- CHF.

- When withdrawing early for a mortage, can multiple accounts be withdrawn or just one? I would guess that multiple accounts can be combined, but have no idea…

Or put differently: Why would anyone NOT want to have 5 accounts and have the added flexibility?

Hi magic_unicorn, the VIAC FAQ states " Are there any fees for deposits or withdrawals? = No. Deposits and withdrawals are free of charge." Where did u read about a Fr 300 fee at VIAC? Greetz.

Sorry I misread. The 300.- are only for early withdrawal. But still…

source: https://viac.ch/en/faq-all/are-there-any-costs-involved-in-closing-or-in-the-case-of-early-withdrawal/

Hello everyone, I am also about to create a new account at VIAC for me and wife, does anyone have a referral code to share with me ?

Thank a lot!

(post edited)

Please use other people codes, my 3 codes were already used.

Thanks Karol, I used 6quqve

Here are my codes:

- Cu4Igv

- SGEMa8

- ZYER8z

We normally suggest a regular account transfer (free of charge) to your bank where you hold your mortgage. Normally your mortgage bank does not charge you for an early withdrawal.

Has anyone looked at putting swiss REIT’s in their VIAC allocation?

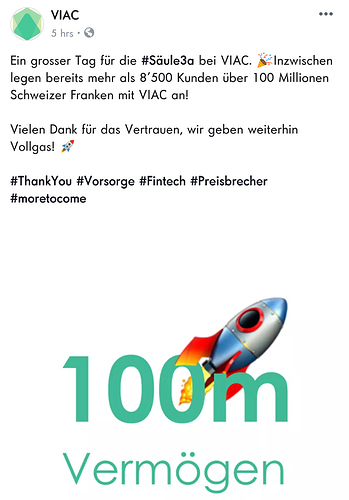

So in a little over a year, that’s from 0 to theoretically 500’000 CHF annual revenue for VIAC from fees. Good for them!

Additionally from the comments:

Web version coming in a few weeks.

Freizügigkeitslösung coming Summer 2019.

I’m probably getting old…but I had an hard time reading the app. I’m using an android phone with a big-enough screen and I believe the shouldn’t use grey text on white background. Also very small. On one graph they use yellow on white…

Hopefully they will let us use a Web based version…

You know, I was set to invest in VIAC last year, I installed their app and all was left was to send the money. Eventually I didn’t make that step. Maybe the web interface will also convince me. I honestly don’t get it why so many apps tie you to use the phone (instagram, whatsapp, uber, revolut). It’s not rocket science to make a web app.

8’500 customers, 100 million AUM, 500k revenue: that’s nice for starters, but I think they will need to multiply it by 10x in order to get profitable. 100 million is impressive, but 500k income is really nothing. This is the money that one manager can make in a year in Switzerland.

Don’t underestimate that. They’ve only just launched. I have people at work with zero financial literacy talking about VIAC. They will grow a lot from here. I wish they were exchange listed so I could invest in them ![]()

I sent the money in December and the portfolio was bought on Jan 3rd, made over 5% since then ![]()

I’m not. Didn’t I write “that’s nice for starters”? If all of these 8500 clients invest 6700 again this year and another 8500 open an account then we have another 100 million in AUM. It’s easy to reach a snowball effect. But 500k of revenue per year is nothing impressive. Especially if there was an initial investor who gave them money to grow. Then they don’t even own that 500k wholly. I guess you’re too late to invest. Unless they would look to offer some new services and need even more cash.

Oh yes, you “made” 5%. Next month you may lose 5%. Unless it’s in your pocket, I wouldn’t cherish it so much. ![]()

Hello everyone, I have the following questions :

-

What is the purpose of having a second portfolio in VIAC in case I just want to have 1 single strategy ? Would be possible to have 1 single portfolio and transfer funds each year to this portfolio ?

-

In my case, I’m interested to build a portfolio which track as close as posible the performance of the FTSE Global All Cap Index (like VT). Do you think this is posible with the current asset List available via individual strategy ?

Thanks!