It’s not optimal, but it’s not at all an issue. If you know, how much the fund is Swiss bias, you can compensate with non 3a investement.

I think is regulated by Law that a certain percentage must be Swiss stocks.

Is not that bad Swiss market is heavily correlated with global market. Roche novartis etc are doing business only internationally

Hey, thanks to everybody for investigating! Looks like a promising competitor for the 3a pillar…

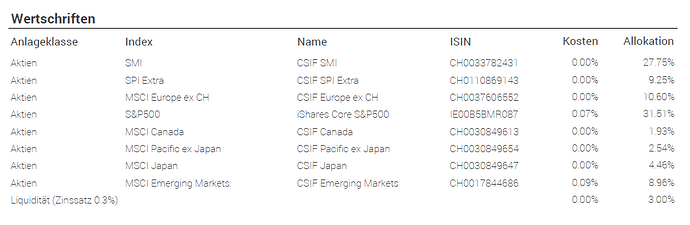

i got a bit interested when the list most of their underlyings as 0%TER:

but indeed, if i check out CSIF SMI, it says

![]()

same for the other CFIS funds.

what do you think makes credit suisse offer funds for free??? lik, in terms of the “free lunch” dogma

Thank you very much for your Feedback regarding our Factsheets - we already improved them.

Checkt it out: https://viac.ch/strategien/

Regards

Daniel

Team VIAC

We were very happy to find out about your discussion regarding our new 3rd pillar app!!

First of all: We plan to roll out the english version in spring!

And it looks like you guys could give us a lot of feedback! If you want we could arange a meeting in zurich to show you some behind the scene stuff and have a little chitchat to improve our product further!

Regards

Daniel

Team VIAC

and if you wondering how I found out about you Google Alerts helped me

Hey Daniel,

thanks for you positive words ![]() I’d actually be very interested in some behind the scenes visit!

I’d actually be very interested in some behind the scenes visit!

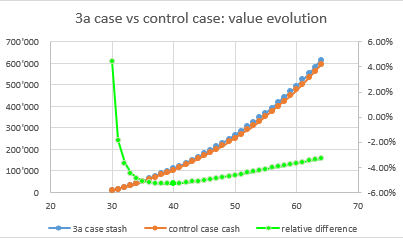

My primry interest is to have a some world portfolio (like my <0.1%TER portfolio) that would pay me a significant premium for the illiquidity that come with the 3a framework. here (excel sheet) i tried to simulate this, and adjusting to VIAC’s costs it looks like

where you can see the premium would be order of magnitude between 3% and 5%. althoug a bit lower than 0.68% of VZ, VIAC’s 0.52% TER still eats off the tax advantage in the big picture.

where you can see the premium would be order of magnitude between 3% and 5%. althoug a bit lower than 0.68% of VZ, VIAC’s 0.52% TER still eats off the tax advantage in the big picture.

so for the cost i like the development, but for me it looks like “not yet there”.

for the technical stuff i can just argue with my taste.

- i’d prefer a VTI over SP500: less TER, more diversification, but US domiciled (in case VIAC can’t qualify as qualified broker)

- I’d rather have a very small swiss allocation, according to the default world portfolio allocation

- if a big swiss portion is required, then I’d have SPI extra higher weighted such that Nestle/Novartis/Roche have the same weight as the top SPE extra positions

- I like that i don’t see CHF hedging, because on the long run hedging is a cost without benefit

- taking out the cash part from the fee and paying interest is a clear win over VZ (altough only 3% of the portfolio…)

on the big picture I am happy to see some new 3a solution that might make it interesting for me again!

Dear all,

i just got a reply from VIAC, which contained some very nice details:

why can they go 97% stocks when before the usual limit was 80%, or even 50% a few years back? => they seem to have still the same regulation, but VIAC is able to apply it to their whole business instead of per customer (what they say is what most others do). Nice Trick!

how can TER be 0.00%? well it is for institutional investors (i still don’t get it actually) but there does apply purchase fees of up to 0.05%. There was no specification if these fees are included in the 0.52% custoddy fee. I’d assume it

looks like a potential cost advantage of 0.4% vs VZ. 0.52 still feels high, but looks like things go the right direction!

I would say that VIAC has a contractual agreement with Credit Suisse. They pay a negotiated amount. It’s not free, it’s included in the commission paid by the final customer to VIAC.

“Purchases of class ZA units must be explicitly provided

for in the asset management agreement, in a similar written agreement, or

in the cooperation agreement. Compensation for the fund management

company and for asset management is charged through the aforementioned

agreements. Costs incurred by the management of Class ZA units

are payable to the fund management company on the basis of a separate

contractual agreement”

Well spotted rolandinho!

Looks really interesting. I had decided not to invest in 3a for the reasons outlined in Nugget’s graph for now but this comes closest to changing my mind. A bit of a premium seems reasonable for the tax benefit.

I especially like the fact that it can be managed electronically and no posting things like with VZ.

The obvious fund seems to be the global 100. Even though it has 40% in swiss companies. Compared to VWRL with a TER of 0.25%, 0.53% and a tax benefit look like good value to me.

Anyone have any reason why this isn’t as good as it sounds? And has anyone been through the registration?

I registered. Smooth process and very modern professional feeling. Next week I’ll transfer my first money

The registration is the easiest I have ever seen for a Swiss bank.

On top of the VWRL TER of 0.25%, you need to add brokerage fee.

Hello Daniel

Good to have an “insider” on the thread.

Thanks for your offer. I would also be interested in a “behind-the-scenes”.

Kind regards

I’ve also registered. Very easy.

Will probably get the money from one of my accounts transferred next week.

Sorry it took me a while to answer, were some busy days lately

First of all congratulation to your very sophisticated analysis! You did a great Job!

In our view we would only add two things:

• The dividend yield you took into you calculation is derived from the Performance. In our view we think it’s better to take a fix rate of 2.5% or so (depending on the Focus; CH SMI around 3%; US SPX around 2%). With an assumed mean return of 4% and your formula the dividend yield is rather low which does not fully reflect tax advantages within the third pillar.

• The tax reduction in Zurich is quite low, it is important for the others to check it individually. WIR Bank offers one of the best calculators I have seen so far. https://www.wir.ch/nc/bank/private/vorsorgen/vorsorgerechner/

In Basel the tax deduction would be 1’685 which exceeds Zurichs 1’010 by far!

• In the beginning we planned to take US ETF for the US Market instead of the Irish one. As there are still some open issues with the Double Tax Treaty CH / USA, taking the irish one makes is better in our handling (witholding tax). We challengend the Tax Authorities (ESTV and SIF, Staatssekretariat für internationale Finanzfragen) regarding the DBA, the Change Protocoll and it’s role under the view of the FATCA. So far no positive results.

• Regarding your strategy, we will allow you to do your own with the release in Spring. The ivestment universe will even grow with some more asset classes and etf/funds!

For us it is a big win to have a community that helps us with ideas and challanges our view  We are always happy to receive Feedback!

We are always happy to receive Feedback!

About the insights meeting: I set up a doodle for a meet & greet!

https://doodle.com/poll/7ydacfwxw25zfvs5

Would be great if some of you can make it! I think near the HB makes sense!

Hey Guys

The decision has been made:

VIAC meet & greet

12.12.2017 @ 11:45 - 13:00

I would propose Spiga; cheap (good for us as startuppers) and italian food (works for everybody I guess)

https://www.google.ch/maps/place/Spiga/@47.3769637,8.5379997,15z/data=!4m2!3m1!1s0x0:0xbb9db18a6d394c0f?sa=X&ved=0ahUKEwiR-8uFhObXAhUPDewKHR1ODk0Q_BIIhwEwCg

Sorry, I had to post it here - wasn’t somehow allowed to post more…

Why does VIAC deposit Cash at the Terzo Vorsorgestiftung and pay only 0,3% interest when Terzo gives me 0,6% if I open an account there?

Is that a hidden fee?

This is very easy to answer: With our product we focus on the investing topic (cheap & efficient). Whereas the classic 3a accounts at Terzo address the “Zinslipickers”. In our view not having bonds in our predefined strategies and having them replaced by interest paying cash was a big win for us. We had some though negations about the interest level and are happy that it is that high compared to other offering in 3a investing field.

If the interest rate is very important to you, I would propose the following: open an account with us, set the allocation to 97% equity and only invest that fraction of the 6’768 that you reach your personal target allocation. i.e. 4’186.40 x 97%; so that it would be 60% out of the full 6’768. the rest of the cash with the bank of your choice; probably WIR Bank as well  But it Comes with some manual adjustments.

But it Comes with some manual adjustments.

So, overall this definitely looks interesting and refreshing on the 3a scene compared to everything else with frankly obscene fees.

How come there’s no currency hedging? I thought it was a legal requirement. Not that I miss, but… is this thing FINMA approved?

Even if limits are mentionned in the law:

"Art. 55 Kategoriebegrenzungen

(Art. 71 Abs. 1 BVG)

Für die einzelnen Anlagekategorien gelten bezogen auf das Gesamtvermögen folgende Begrenzungen:

a.2 50 Prozent: für schweizerische Grundpfandtitel auf Immobilien, Bauten im Baurecht sowie Bauland; diese dürfen höchstens zu 80 Prozent des Verkehrswertes belehnt sein; Pfandbriefe werden wie Grundpfandtitel behandelt;

b. 50 Prozent: für Anlagen in Aktien;

c. 30 Prozent: für Anlagen in Immobilien, wovon maximal ein Drittel im Ausland;

d. 15 Prozent: für alternative Anlagen;

e. 30 Prozent: für Fremdwährungen ohne Währungssicherung."

The Swiss Federal Council federal Concil has precise this point in a comment during the law adaptation in 2008

Press release

FR: https://www.admin.ch/gov/fr/accueil/documentation/communiques.msg-id-21512.html

DE:https://www.admin.ch/gov/de/start/dokumentation/medienmitteilungen.msg-id-21512.html

Even if the limit are still in the law, the comment of the law

FR: https://www.newsd.admin.ch/newsd/message/attachments/13874.pdf

DE : https://www.newsd.admin.ch/newsd/message/attachments/13873.pdf

mentionned that if the pension fund manages without excessive risk the money under management it can go beyond the limit.

The law article 50 will have more importance than Art 55 which mentions explicitly the limit:

"Art. 50 Sicherheit und Risikoverteilung

4 Sofern die Vorsorgeeinrichtung die Einhaltung der Absätze 1-3 im Anhang der Jahresrechnung schlüssig darlegt, kann sie gestützt auf ihr Reglement die Anlagemöglichkeiten nach den Artikeln 53 Absätze 1-4, 54, 54a, 54b Absatz 1, 55, 56, 56a Absätze 1 und 5 sowie 57 Absätze 2 und 3 erweitern. Anlagen mit Nachschusspflichten sind verboten. Ausgenommen sind Anlagen nach Artikel 53 Absatz 5 Buchstabe c.4"

It’s a little tricky, but if you read the comment, it has been decided not to remove the article 50 with the explicit limit, because:

"

• Anlagekatalog und Begrenzungen sind nach wie vor für viele VE und Aufsichtsorgane

eine wichtige Orientierungsgrösse. Die Prudent Investor Rule beinhaltet

sinngemäss ebenfalls Begrenzungen. Klare quantitative Begrenzungskriterien

erleichtern den Vollzug und führen in der Praxis zu weniger Interpretationsschwierigkeiten.

• Annexeinrichtungen, bei denen die Risikofähigkeit und damit auch sinnvolle

kassenspezifische Begrenzungen nicht bestimmt werden können, benötigen

diese Vorgaben.

• Die Abschaffung von Anlagekatalog und Anlagebegrenzungen könnte eine

falsche Signalwirkung haben."

Waiting the confirmation from VAIC, I would say that their offer complies with the current law.

Money transfer no issue. Very responsive on the chat. A couple of days after the 1st of the month you will see the assets invested in your chosen strategy. Since i put only some hundreds francs, they couldn’t fully replicate the global 100 strategy, but they got close enough. Looking forward to move all my 3a assets in 5 different portfolio there. Overall the nicest and more modern interaction i have ever had with a financial institution