I’m a happy customer and would gladly refer anybody who wants a reduced fee… Contact me

I just made my own portfolio, feels great

I’d also happily refer anybody who wants to have a reduced fee.

i just thought the saving possibly becomes CHF1500*0.0072=10.8CHF p.a., compounded at 5% and 30 years results in just below CHF 1000.

ok i will also refer from now, gladly^^

I have also tested the VIAC app, seems very good and has some nice features, in addition I’ve had some contact through the chat function with a great response.

I would be interested if there a Mustachianpost consensus on a strategy now that its possible to select your own portfolio?

Swiss allocation and the rest in World (ex CH)?

for my viac portfolio i picked

30% SPI extra

2% SLI or SMI (cant remember)

5% swiss real estate

30% CSIF world ex CH, unhedged

20% CSIF world ex CH small, unhedged

10% EM

3% cash

goal: long term (35y) maximal returns.

i didnt put lots of thought in it, i am curious what others have!

Nice Portfolio nugget, but it adds up to 105%?

I chose a similar Portfolio:

35% SPI extra

2% SMI (because SLI has 0.2 TER)

35% CSIF world ex CH, unhedged

15% CSIF world ex CH small, unhedged

10% EM

and the mandatory 3% cash

Whats the deal with swiss real estate, is it worth it?

My strategy will be to create 5 portfolios, not sure if I will go with one strategy for all of them or vary a bit.

EDIT: I went with the SLI after all, TER is not worth looking at with an allocation of 2%. I prefer the SLI in this case because its capped

I have a Degiro account with a mix of small/mid/large cap US markets, emerging markets and developed Europe ETFs.

I was thinking something along the lines of:

17% SPI extra

20% SMI ( exactly because SLI has 0.2 TER)

40% CSIF world ex CH, unhedged

20% CSIF world ex CH small, unhedged

3% cash

goal: long term (35y) maximal returns.

Since you are forced to have 40% swiss equity, I would always max out SPI Extra with 35%

Why? Because the SMI is terrible with (a) only 20 companies and (b), Nestle, Novartis and Roche making up ~60% of the SMI. imho in terms of diversification the SPI Extra is the best offering covering swiss mid and small caps. Plus you get access to swiss small caps, not something you get easily as a retail investor I think.

Are you guys already rebalancing to this Individual strategy or are the posted strategies just “the plan” at this point. I am/was looking on doing a rebalance now (end May), but can’t find the possibility on the App, apart from the standard strategies.

PS I’m an existing user and also open for referring others

I didn’t find the feature either…

I switched my strategy and It’s going into effect tommorow.

You guys need to have the latest version of the app and then go to the box “Strategie” > Strategie anpassen > Fokus anpassen.

It should be there.

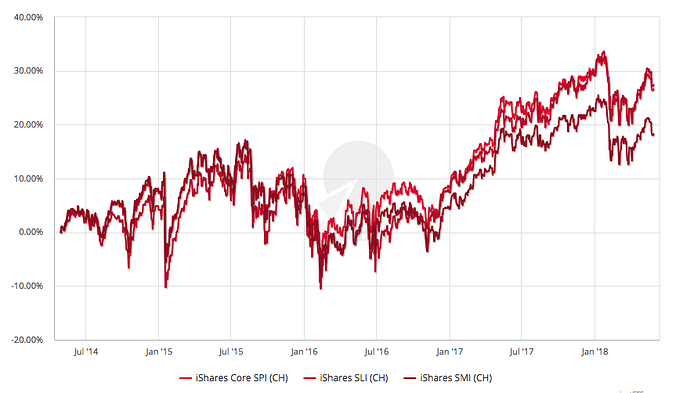

You are correct Joey, The SMI lags the others according to JustETF data (lowest plot).

Thanks for the input

Yep was just looking at the same chart

But watch out! the fund you have, iShares Core SPI is not the one you are invested in with VIAC.

Take a look at this: https://www.six-swiss-exchange.com/downloads/indexinfo/online/share_indices/smi/smifamily_factsheet_en.pdf

The iShares SPI covers almost all listed swiss stocks but the Top3: Nestle Novartis and Roche still are a huge part of it

What VIAC is offering is the SPI Extra, basically the SPI minus large caps. So you dont have this problem with the Top3. You cant see this fund on justetf.

Yes, excellent point.

@Joey

yes, SMI/ SPI are poorly diversified, but at my 2% allocation the big 3 might be 0.6% each of my portfolio which is really no problem.

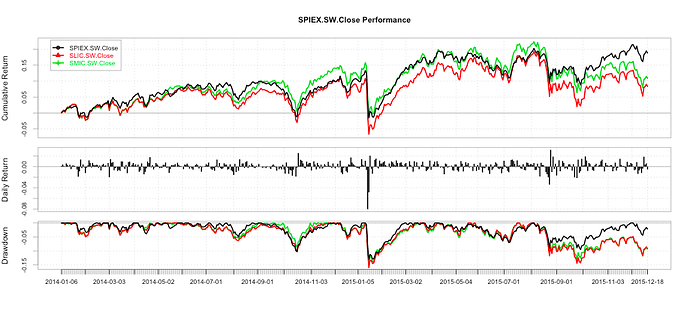

I hope the tickers are correct  bit tricky these SMI/SPI/SLI

bit tricky these SMI/SPI/SLI

Seems the SPI Extra is interesting (this is from 2014 as per just ETC), similar outcome if you go back to 2010.

Maybe interesting…

I was already asking about it earlier in the thread. Basically SPI = SMI + SPI Extra.

Please don’t look at past performance as a main reason for your decision what to invest.

I don’t get it why when investing globally, you’re fine with market capping, but in Switzerland you have a problem with Nestle, Roche and Novartis. Yes, these are huge companies. If they split into 10 smaller companies, would you feel better? The logical market capped choice for Switzerland is SPI, not SPI Extra. Does VIAC offer the SPI anyway?

Is it still only App based or works on Browsers as well?

No Viac doesnt offer the SPI directly, you would have to create it out of Extra and SMI.

I just dont feel comfortable having such a heavy weighting of the top 3 in my viac portfolio. I am already exposed to Nestle Novartis and Roche via VT/VXUS at their appropriate market cap. Why overweight them again with viac?

Your total exposure to the big three within VT is around 1%. Within SPI it’s 47%.

If you put 40% of your 3a into SPI, then the exposure will be 40% * 47% = 19%.

If you, however, go for SPI Extra, then you will have 40% exposure to very small companies, probably much more attached to the Swiss economy than NN&R.

Nestle is a multi-brand giant with factories in many countries. I can imagine it provides a better regional diversification than SPI Extra. What SPI Extra provides, is maybe a better industry diversification.