Capital gains is still untaxed, so the effective tax on your profits is less than income from work.

Should you care?

While capital gains “usually” occur because of rising yearly profits, they don’t have. Berkshire Hathaway is a prime example: They don’t have to increase profits year over year - as long as they retain them in the company, the stock price will rise.

What happens if a company buys back its own stock? All other things equal (equity, profits), the company’s share price will rise. Effectively, they serve as an alternative to dividends in distributing profits to shareholders. That’s why you call it “a fluid border” between capital gains and dividends.

However, from a shareholder’s tax perspective, these “transactions with shareholders” will be taxed differently.

While you pay local income tax on dividend payments in most countries, capital gains from share buybacks are tax-free in Switzerland (for individuals). In many other countries, they’re at least privileged with a preferential tax rate (such as lower capital gains taxes for longer holding periods).

Unsurprisingly, many companies have been aggressively expanding share buybacks.

Reading the text of the initiative, this is totally crazy. Even the name of the initiative is totally wrong!

All working Swiss people have capital at work; it’s called the second pillar.

Wanting to tax capital gains is the worst idea I’ve ever seen. And they are not even talking about abolishing wealth tax in exchange. I mean, how radical can you be?!

I urge all the Swiss Mustachians to vote NO to this initiative which goes against FIRE principals.

The parliament will be responsible for implementing the initiative. They will define the term “capital income”. It is almost certain that capital gains won’t be included with it. The same for the virtual income from self inhabited real estate. The second pillar doesn’t yield any capital income from a tax perspective, so won’t have any effect as well.

There will be an exception of some amount where the 1.5 multiplier won’t be applied. 100’000 chf has been suggested, but it could also be higher. (Lower is pretty unrealistic)

At current dividend yield you need around 5 Million chf in taxable wealth (no 3a) to get enough capital income to be affected by it.

Less than 1% of taxpayers have that much taxable wealth.

Well, the initiative has been written obviously by a bunch of anti-capitalist. In fact I am also in favor to fight inequality but that way does not help anyone. I keep thinking that this vote is some kind of backfire from the “réforme de l’imposition des entreprises II” which was accepted in 2008 and which introduced the possibility to distribute the capital gain of the company as not taxable income.

If the increase of the price of shares ( Aktienkursgewinne usw.) is considered then you are subject to this tax usually as soon as your wealth is 1 Million invested in stock.

Yea, I guess so.

However hypothetical scenarios that have no chance of actually happening are quite irrelevant.

The second pillar will not be affected.

Payouts from the 2nd pillar are already taxed at preferential rates today.

Increasing taxes on capital payouts on 2nd pillar payouts is never, ever, going to happen through this initiative. It’s just not politically viable - because it would affect too many average earners, especially the unemployed (before reaching retirement age).

You’re clearly living up to your name ![]() considering that taxation of capitals gains is a reality in most developed economies in the world.

considering that taxation of capitals gains is a reality in most developed economies in the world.

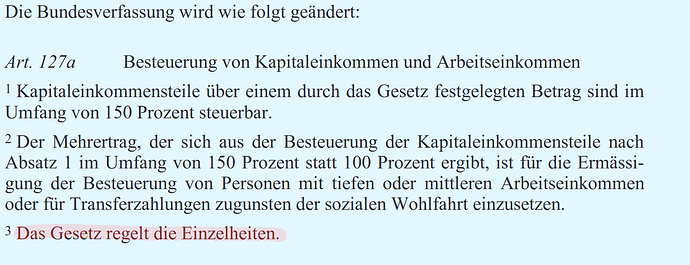

“Das Gesetz regelt die Einzelheiten”

Capitals gains are taxable income in most developed nations in the world.

They are not in Switzerland (for individuals) today. And as long as they aren’t defined by law to be taxable income, they won’t be taxed any more than today.

Changes in tax laws could, potentially, redefine the definition of taxable income (to include capital gains). Then, and only then would they be covered by the proposed constitutional article.

The initiative is merely allowing for future changes in law and (truthfully) acknowledging that.

It’s really simple:

They could have included it in their proposal text:

4 Kapitalgewinne sind steuerbares Einkommen.

They chose not to.

Your comment about riots on Paradeplatz is just FUD.

Ok, so another useless toothless left populist initiative. Same guys that were behind “responsible concerns”, “speculation with commodities” initiatives?

Current tax is zero. 150% of zero is zero. Do I miss something?

True.

Seems amateurish not to include it in their proposal then.

Or a clever way to propose advertise (with) something that they aren’t really actually proposing (with this initiative).

Still, if the taxation of capital gains isn’t in the proposal, nothing is going to change in this respect, for the time being.

I don’t doubt that they / someone will make further attempts to make them taxable.

As a side note, I think they should be taxable, to address the difference in taxation to dividends.

Great, so you’re in favor of raising taxes for the sake of making them more technically correct?

@xorfish I get the feeling, you’re in favor of the initiative?

To me that’s frightening. I thought mustachians would be the first to fight it tooth and nail.

Whenever I hear the ideas of “junge sozialisten”, I shake my head. If this is the generation that will replace the elderly conservatives, then the course for this country is set.

The fact that most “developed” countries have CGT, means that it’s a good thing? Developed doesn’t mean right. When you examine history, prosperity is not given forever.

My plan is to save enough capital to be able to retire here in Switzerland, and the lack of CGT is a contributing factor. Rich people (far richer than me) have high mobility and high incentive to look for better options. You want to chase out wealthy pensioners, this is the way to go.

Not necesseraly, I am aware of my privileged situation and am willing to pay up for a functioning society where noone is left on the side of the road. By privileged I mean :

- I am white and male

- My parents took care of me and had my best interest in mind

- I happen to be born in a country where education is for free

- Despite some personal difficulties which showed me how fast it can get to get on a dark path, there was always enough security around to bounce me back. Without it I would be probably a dead drug addict.

A lot of people don’t have that chance, and if I can make a modest contribution, lets go for it. In Marseilles (France) they did a study of giving homes for free to people who got homeless with some astonishing results. For instance, most of the people could get reinserted in less than a year into some workforce, even if they were not

I am for a better distribution of wealth since the scientific research shows that this would make a more liveable society as a whole. BTW before someone mentioned cirminal ridden France. I lived there and I can’t concur, and I would say that the countries with a total neoliberal program like the US and the UK have a much higher criminality problem.

BoJack : honestly that would mean you have to work maybe what, one or two years longer to compensate for it ? Ist that such a pain in the ass you are not willing to do that effort ?

Furthermore, as a mustachian it mostly does not touch me, because my minimalist lifestyle implies that I am nearly not touched by it. I don’t need that much as wealth to live a happy life. If you need 5 MCHF (or whatever that number is) to be happy, I would suggest to review your source of happiness. Just my 2 cents.

Finally, I kind of fancy the idea as a start capital for everyone, since this is known to be a issue for some time, that young people have more difficult access to it (more precarious employment, delayed and reduced inheritance because of concentration of wealth etc.)

Do we have a problem with that in Switzerland, currently? You think not enough is done? I’m not saying we should remove the existing safety net, I’m just saying enough is enough…

It’s not one or two years longer. We’re talking about this particular initiative, but in a broader sense it applies to all taxes. If you calculate all the taxes that are applied between you earn the money and finally spend it, in many countries you spend well over a half on taxes! Just add together the social contributions, employer’s taxes, your income taxes, VAT, tax on dividend (which is re-taxing what already has been taxed).

The socialist tax policies eventually hit the middle class, the aspiring young people who want to build their capital. There is a huge difference between saving 50% and 30% of your gross income, with regards to when you can retire. And if you also have to pay higher taxes once retired, that also pushes it by a few years. Eventually, in a highly taxed country FIRE is very hard to achieve and it’s maybe better to not even try. Just work a bit, then go on unemployment leave, not get too stressed. After all the state will take care of you no matter what, right?

In most places in the world I would agree, I don’t know where you live but I would qualify that statement that if you are a family of 5 that wants to live in a moderate house with small garden in canton Geneva, then 5MCHF is not such a crazy FIRE wealth by any means on a safe 3% withdrawal rate.

Actually, reflecting on this I might feel more supportive of increased taxes if I did not live in Geneva, we have a relatively high redistribution of wealth here and something like 40% of taxpayers people don’t pay any tax at all (can’t find the statistic).

Suppose you live in CH and have a marginal tax rate of 40% and invest in a US company, where the new Corp tax rate is to be 28%. If the company earns 100$ profits before tax that get paid out as dividends, then today you end up with 43$. With the new initiative you would get 29$. I just think it is too much tax

The stated objective is to penalise rich business owners and help workers. Is that really what we want ie push away anyone who has an idea for the next Facebook or Amazon ?

I am definitely not for this initiative.

With regards to Captial Gains Tax, I personally profit from its absense and am happy to do so. I can, however, also understand the arguments for some sort of tax on capital gains.

Hmmm. Funny, I thought that it became clear in that discussion that there are some full blown idiots that lack the intelectual capacity to distinguish between scientifically proven facts and weird internet conspirracy theories.

Seems we all have our own perceptions…