Hi Mustachians,

Need your help to conclude !

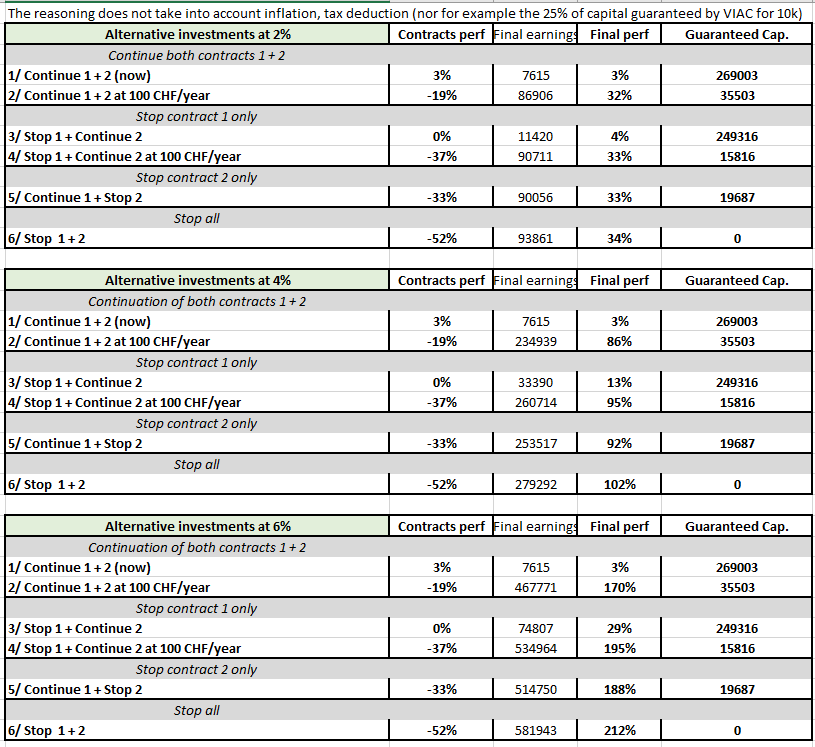

I finally get all data to analyze my 3rd pillar situation.Currently, two contracts :

1 - An old contract with a surrend value from, from 2020 (12k) to 2056 (20k), without any payment additionnal per year

2 - A recent contract from 2020 (8k) to 2056 (249k), 6500 paid once a year, can be reduced to 100/y minimum

I analyse all possible options with these contracts :

Perf. ratio is Earnings(=capital-cotisations)/cotisations

Finally, the conclusion seems quite obvious…

- risk pays (classic)

- Contrat 2 has to be reduced or stopped

1/ Is it your thoughts too ?

IF YES, I am focus on the “5 third pilar strategy, and VIAC seems to have the lead”

2/ According you :

- In this recession context, I think a secure strategy (mainly bonds) will be preferable for these 20k (all transfered on one VIAC account, and open 4 others). When markets will be lower, will it be possible to immediately switch the strategy to a mainly stocks one ?

3/ Is it logical to think that, by investing that way my third pillar (stocks, bonds with VIAC), I must reduce my investments on the broker where I am already invested on stocks (to keep an balanced portfolio).

Have a nice evening !