In your case, it might be worth considering VWRL in Swiss francs. While there are stamp duties, there are no currency exchange fees. It’s advisable to review the conditions provided for bank employees. Without clear reasons, switching from VTI to an Irish fund doesn’t seem necessary.

I only invest in the US stock market outside of 2nd/3rd pillar (overall asset allocation is close to VT). But holding VTI with a Swiss broker results in a 30% withholding tax on dividends. An Irish-domiciled ETF on the contrary has 15%. With an average dividend yield of 2%, I lose out on 0.3% in returns.

FX exchange fees are 0.17% margin on interbank rates, so it’s still rather cheap. Buying fees are 0.90% (minimum of CHF 30).

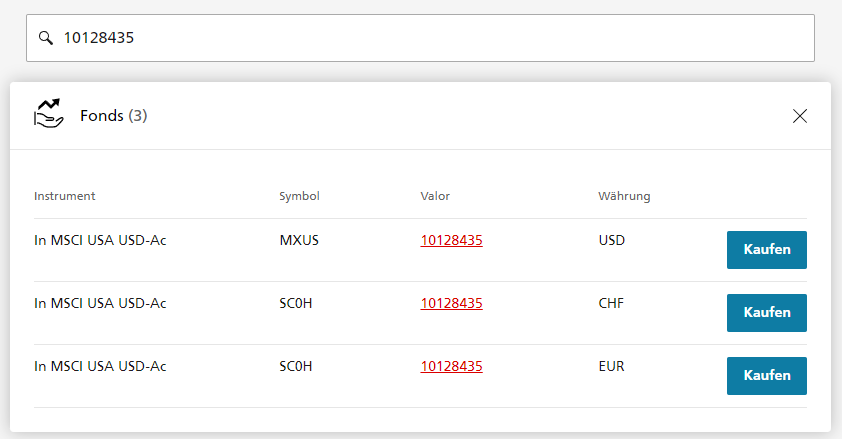

UBS ETF (IE) MSCI USA UCITS ETF (USD) A-acc might be a wise choice aswell?

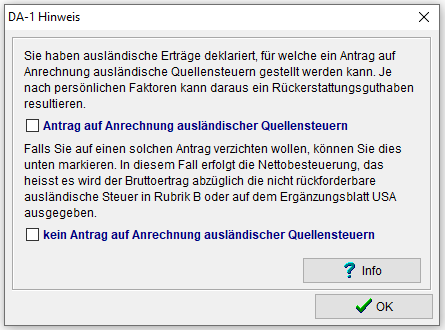

And you don’t recover it with da-1 (+supplemental US)?

An Irish ETF would make you lose 15% irrecoverably.

I’m not sure if this is possible with a Swiss broker? Or does it not matter which broker you use? Can I recover 15% or the full 30%?

Large/competent brokers should work (and recover 30%).

Still depend on other things whether you’re eligible for da-1, eg if you have large deduction/low tax rate.

Someone in this forum said that with this ETF: https://www.justetf.com/fr/etf-profile.html?isin=IE00B3YCGJ38

You should have 0% witholding due to the fact that it is a synthetic/swap-based ETF.

https://www.invesco.com/ch/en/insights/does-synthetic-replication-offer-an-advantage.html

You are right. Invesco states this also on their website. It’s also accumulating which would reduce my costs even further (as I don’t have to reinvest the dividends with a 0.9% buying fee). Would you favour this over VTI in my case?

There is still the counterparty risk and we are talking about life savings in the end.

Well, it depends on your aversion about synthetic ETF, not sure if they are riskier than the usual physical replication.

You have the S&P500 one : Country Splash | Invesco Schweiz

And the MSCI USA one : Country Splash | Invesco Schweiz

In your case, if buying in USD is not to expensive, it could be a great solution. The fact that it is also a capitalisation one offer you peace of mind about dividend conversion.

This is my point of view.

Their reference benchmark is SPTR500N, I guess this assumes 30% tax on dividends. Might be interesting to compare the returns to SPTR500 instead.

There is even a CHF-version: https://www.justetf.com/ch/etf-profile.html?isin=IE00B60SX170#uebersicht

Which would further reduce my buying costs as I could just buy it without the FX exchange.

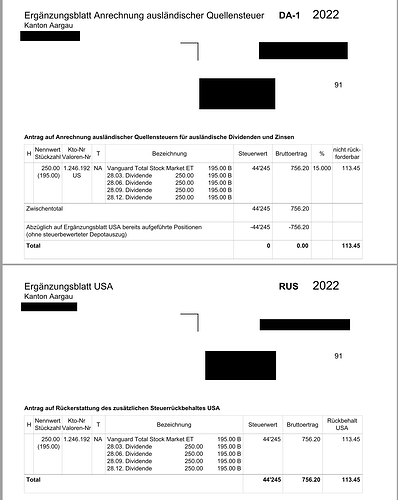

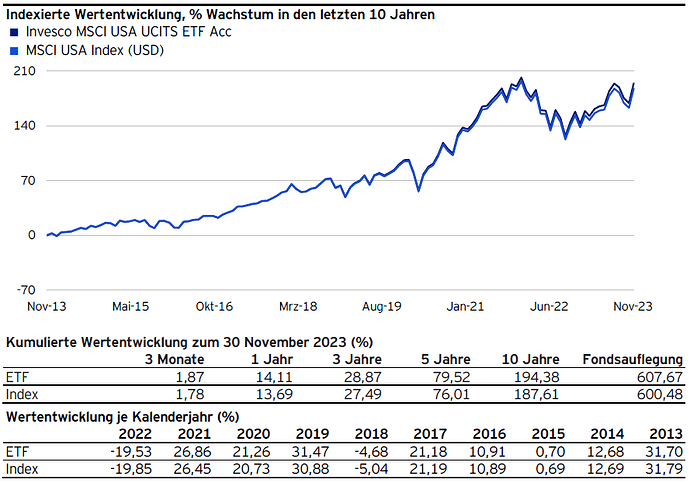

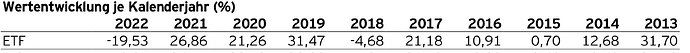

I just wonder what happened after 2017 when this ETF started outperforming its underlying index. Total outperformance is 7% if looking at the last 10 years. Maybe as @nabalzbhf pointed out it’s due to the performance drag of withholding taxes which don’t apply for this fund.

With this, you unconditionally get 15% back via R-US and you get an additional tax credit of up to 15% via DA-1 (it depends on your relevant Swiss tax rate, likely the full amount in your case). That’s assuming your declaration is accurate, i.e., your bank is an IRS qualified intermediary and deducted 15% US WHT and 15% extra Swiss withholding, not 30% US WHT.

If you sign the W8-BEN for treaty benefits, you will get taxed 15% (double tax treaty reduced rate) + 15% (Swiss supplement as per DTT).

The Swiss supplement is always recoverable in Switzerland if your dividends are declared. The other 15% is claimable using the DA-1 (reimbursed totally or partially depending of your personal situation. It has been discussed in this forum already)

Are you sure about the CHF version? I think that justETF convert it automatically in the currency exchange website version if you are a swiss investor because it said that you can buy this ETF in USD on the SIX Swiss Exchange.

Maybe if you trade it on the BX Bern Exchange?

Iirc this was discussed before, IRS rules allowed to remove some tax drag for those ETFs. I don’t remember the detail and whether there is now no tax drag at all.

Just be careful about the index used. We need to compare with MSCI USA gross index

https://www.msci.com/documents/10199/67a768a1-71d0-4bd0-8d7e-f7b53e8d0d9f

Invesco ETF returns:

MSCI USA gross returns:

Broker domicile usually shouldn’t matter regarding taxation (though there are some exceptions - and often the practical question if and how you can recover tax withheld in practice, i.e. what documents need to be provided to whom).

As @nabalzbhf said, I would assume 15% U.S. tax (non-refundable from the U.S. but probably eligible to be offset against your Swiss tax through DA-1) and an additional 15% withholding in Switzerland, refundable from the Swiss tax authority.

Did you look at the actual dividend statements how much was deducted?

I have 3 fund options. The CHF-version is traded on XBRN, the USD-version on XLON and the EUR-version on XETR.

@San_Francisco

Yes, the last dividend in September got paid out with a 30% deduction. But as you and 2 others here are suggesting: 15% is offset through DA-1 and 15% is recovered through RUS.

So maybe I should just try it out with my next tax declaration early next year and see how it goes. If I get the full 30% back, I’m going to stick with VTI. Otherwise I might use the Invesco MSCI USA ETF with 100% dividend payout.

So it’s traded on the Bern eXchange (BX Swiss), this is really nice ![]()

I may be a bit pedantic, but it‘s not really a different „version“ (share class) of the fund - it‘s just different exchanges allowing trading in different currencies (if you bought a distributing fund in CHF, you will still get receive dividends in the fund‘s currency, e.g. USD).