I used to be mostly indifferent to having so many pension funds in Switzerland, leaning towards having fewer, since every single one adds overhead, needs the same backoffice staff doing the same backoffice stuff, needs an overpaid CEO, etc.

Having fewer of them simply eliminates the same work being done (and paid for) multiple times.

Having some competition between the players is what pushed me towards “yeah, probably not really that efficient but maybe mostly fine?” Even though admittedly, they probably all run the same calculations: what are the outgoing cash flow needs for the next 120 months in the future, what are return expectations over the next 20, 30, 50 years in the future for asset classes x, y, and z, etc.

I am not really sure where I stand on this now.

One thing though I can state for sure: the rules are probably too liberal for now. In my personal situation, I work for an asset allocation company. They chose a pension fund that allocates the company’s pension capital – exclusively, as far as I can tell – in funds managed by the company I work for.

WTF for several reasons …

Sure, my company doesn’t own the assets in my pension fund pot, but things will surely take a while to sort out if the company goes belly up and the funds the company manages assets for a bunch of different clients.

This should simply be forbidden, IMO, as the only one profiting is my company (i.e. the owners of this company).

Better yet: my company charges fees on assets they manage. Essentially, a fixed % portion of the money going into my pillar II (both by myself and by the company) gets siphoned into the company’s profit bottomline. Profiting the owners of this company.

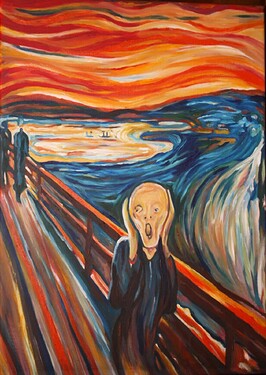

Current feeling after writing this: